The pandemic has resulted in e-commerce growth that was unpredicted. In March 2020, global retail website traffic hit 14.3 billion visits signifying an unprecedented growth of e-commerce during the lockdown of 2020.

Recent studies show that consumers prefer e-commerce and will continue using online services even when in-person services are available. The studies show that in the US, as many as 29% of surveyed consumers state that they will never go back to shopping in person again; in the UK, 43% of consumers state that they expect to keep on shopping online even after the lockdown is over. Retail sales of e-commerce show that COVID-19 has had a significant impact on e-commerce, and e-commerce sales are expected to reach $6.5 trillion by 2023.

During the COVID-19 pandemic, healthcare has also experienced many unpredicted challenges that have had an impact on healthcare services. The adoption of infection control measures, ICU expansion, rehabilitation services for COVD-19 patients, ongoing testing, vaccination services and the provision of virtual healthcare visits are some of the many changes that have occurred in response to the unpredicted challenges caused by the COVID-19 pandemic.

The History

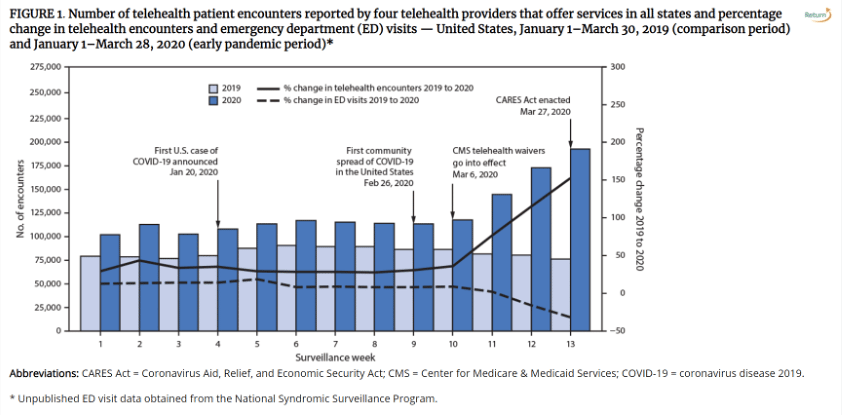

In years past, the provision of virtual services in healthcare has lagged behind the use of e-commerce in consumer-facing industries. However, like e-commerce retail, the shift to virtual care during the COVID-19 pandemic has demonstrated that the delivery of virtual care visits is possible in healthcare. The pandemic has influenced consumer preferences including consumer preference and demand for virtual healthcare services. From the CDC:

As healthcare virtual visits have increased, surveys indicate that both consumers and physicians prefer virtual care services. Physicians widely prefer offering virtual visits. As of April 2021, 84 percent of physicians in the US were offering virtual visits and 57 percent would prefer to continue offering virtual care.

Additionally, consumer surveys have indicated that more than 40% of consumers said they would rather access healthcare services virtually or through a combination of virtual and in-person visits. Nearly two-thirds of consumers say access to telehealth (virtual visits) will be an important factor in deciding where to obtain care in the future. Prior to COVID-19, only 11 percent of consumers were using telehealth. In specialty healthcare, such as mental health, there has been a significant increase in virtual visits. For example, psychiatry virtual visits have increased by 50 percent and substance-use treatment virtual visits have increased by 30 percent.

What Impact Could Telehealth Have on Healthcare Finance

Given the shifting consumer preference for virtual services, healthcare organizations need to make strategic decisions on how to effectively respond and provide a new healthcare service model. Will virtual visits become the major care delivery model and surpass in-person visits as patient demand grows? Given the potential demand, should healthcare providers, especially Physician Services, respond to consumer preference for the inclusion and expansion of virtual visits?

Most healthcare systems are closely monitoring reimbursement for virtual visits. As part of its initial response to the COVID-19 pandemic, the Secretary of Health and Human Services waived the geographic and location requirements during the national public health emergency (PHE). The Secretary expanded Medicare telehealth coverage for services furnished to a beneficiary in his or her home (or any other location) without regard to whether the beneficiary resides in a rural area. Additionally, the Centers for Medicare & Medicaid Services (CMS) has published two interim final rules (IFR I and IFR II) further eliminating barriers to telehealth adoption during the PHE.

Moving Forward: The Impact of Telehealth

As reimbursement changes to include increased use of virtual care visits and services, what are the next steps for healthcare planning and management?

Fully understanding the impact of COVID-19 on care services and delivery is essential. There are many areas that should be assessed to determine the scalability of virtual visits and the feasibility of cost savings if a hybrid care model (virtual and in-person visits) is adopted. Can in-person clinic hours be reduced, and virtual visits increased? Analysis of visit trends, pre-COVD-19 and current visits, as well as if and when the virtual visits were available, is needed to inform how to provide consumers with their preferred care delivery. Further, an assessment of how a hybrid care model including virtual visits will change the day-to-day operations of healthcare, as well as the utilization of existing in-person clinic sites, is needed to develop the new care model. The information needed for the strategic planning and development of a new care model can be found in healthcare decision support systems, such as Affinity Decision Support (ADS).

Comprehensive information including clinical, utilization, and financial information is integrated in a decision support system and can be leveraged to inform the strategy and response for a care model to meet consumer preferences and the incorporation of virtual care into that healthcare model.

To learn more about ADS and how our expert healthcare consulting team here at Harris Affinity can help your organization achieve success in the hybrid world of virtual and in-person healthcare services, contact us today.

About the Author

Penny Weeks, Vice President, Professional Services

As a senior executive experienced in successfully leading complex operations and long-term projects in multiple sectors, especially healthcare, Penny is a recognized thought leader who fosters client engagement to provide innovation and advancement of healthcare information management throughout the healthcare system. She has also provided strategic direction and leadership for the development and implementation of Ontario’s provincial case costing initiative. Penny earned her MBA from the University of Toronto.