There are plenty of articles and information available about what a rolling forecast is and how to implement one. Simply Google “rolling forecast” and you will be overwhelmed by the amount of content available on this subject. Some of these articles get into the details of the general benefits of using rolling forecasting as part of strategic financial planning, and they discuss why you might choose to use these methods as part of your planning initiatives.

The choice just got easier. Applying rolling forecasting techniques in some capacity is no longer a luxury, it is a necessity. The main reason for this is based on the changes in price index and inflation rates that have occurred since March 2021.

If you were not using rolling forecasting methods in 2020, when you created your 2021 financial plan, you are currently experiencing major variances in your budget to actuals reporting. These variances are on course to increase in intensity as we move into 2022.

Hospitals and healthcare systems are not insulated from the impact of major economic changes. In some areas, like high ticket medical supply items, the impact can be devastating. Even if they are events that you cannot control, it is still imperative that you forecast as accurately as possible. Having accurate and timely forecasts will reduce the risk of gross loss caused by stale projections, which provides an opportunity to make real-time decisions in areas that you can control in order to absorb some of the financial burden.

Below are a few example graphs that tell the story of rolling forecasts vs traditional budgets.

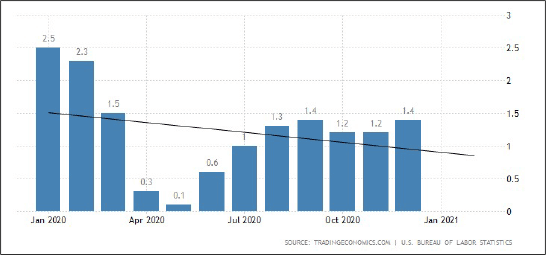

Fiscal year 2020, January-December: US Inflation rate

If you were using a traditional budgeting method that is based on the prior year history, the chart above shows the information that would have been the basis for your inflationary rate calculation. From January through December of 2020 we experienced a downward trend. The result of a calculation using this information would have yielded a downward projection with a lower rate of inflation.

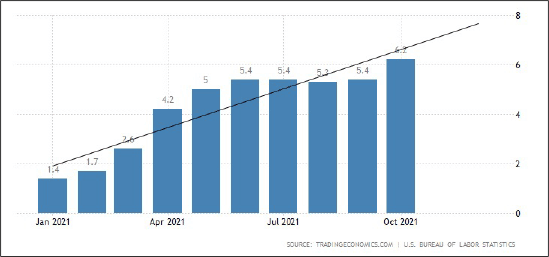

Fiscal year 2021, January-December: US Inflation rate

Now, if you owned a fully functioning 1981 DeLorean DMC-12 time machine capable of getting up to 88 miles per hour and a working flux capacitor, like the one used in the movie “Back To The Future”, no problem. But if not, based on the reality of this graph – which shows the rapid increase of the US inflation rate over the course of 2021 – your overall average budget to actual expense variances would be about 726.67%.

This is based on the difference of a projected downward trend starting at 0.75, at the end of 2020, compared to a rate of 6.20 and rising. It might seem like a farfetched example, but this is reality. How would you feel if you were the person responsible for explaining this variance to executive leadership or a board of directors? Presenting it as an “anomaly” is not an option. The entire situation could have been avoided by using, you guessed it, rolling forecast.

So, exactly how would a rolling forecast vs this traditional budget approach have avoided underestimating the inflation rate by such a gross margin?

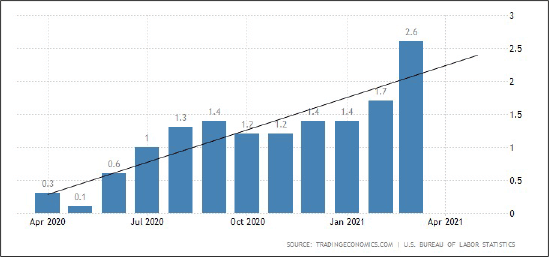

12 month rolling forecast: April, 2020 through March, 2021: US Inflation rate

By recasting projections on a quarterly or monthly basis using a 12-month rolling financial forecast, your projections would have been adjusted in the first quarter of 2021. This final chart shows the inflation rates and trend for the 12-month period of April 2020 through March 2021.

The 2020 trend line was descending and ended at about 0.75, and the graph above (based on a rolling forecast method) ends on a rate of about 2.75, showing an ascending trend. Using this difference in rate and direction significantly impacts the original forecast and delivers meaningful analysis that will help to ensure the financial health of the organization. Rolling Forecast capability provides insights to dynamic directional shifts, which leadership can use to reduce the risk to unfavorable financial events in a current year.

Do you want to be in a position where you need to explain a 700% variance?

Or, do you want to be in a position where you can provide intelligent financial guidance to your organization?

Join us on December 8, 2021 for our Rolling Forecasting webinar where we will demonstrate these concepts as they apply to strategic financial planning using the Harris Affinity ADS Budgeting and Planning Reimagined solutions. Contact us today to see how Harris Affinity and our Affinity Decision Support (ADS) solutions can benefit your healthcare organization.